How to Apply for Medicare

Applying for Medicare? You don’t have to be overwhelmed by the process. We cover what you need to know. Gain clarity with your step-by-step checklist or speak with an expert advisor.

Whether you plan to apply for Medicare now or in the near future, our team of advisors will guide you and advocate on your behalf every step of the way. From researching and comparing plans to help choosing a plan and enrolling, we do the heavy lifting, so you don’t have to spend countless hours figuring it out on your own. Our support doesn’t stop there - we want to ensure you have all the health insurance tools you need, which is why we provide lifelong assistance to all our clients.

If you have questions or want to begin your transition to Medicare, call our team to get started. We’ve helped over 50,000 individuals in Ohio, Kentucky, Indiana, Pennsylvania, and Florida find the right plan.

Eligibility

Who is eligible for Medicare?

Individuals must be a U.S. citizen or permanent legal resident for at least five consecutive years. You must also meet at least one of the following criteria for Medicare eligibility:

- You are age 65 or older and eligible for Social Security

- You are permanently disabled and have received disability benefits for at least two years

- You have been diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS or Lou Gehrig’s disease)

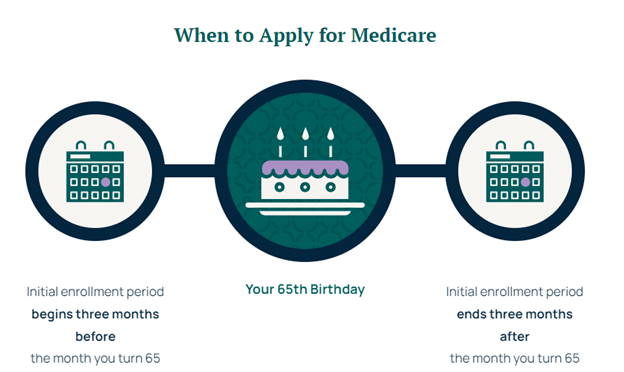

When do I apply for Medicare?

1. When You Turn 65

The majority of individuals enroll in Part A (hospital insurance) and Part B (medical insurance) when they're first eligible at age 65. Enrolling in Medicare at the right time is critical to ensure you avoid penalties and gaps in coverage.

Retirement is not a requirement for Medicare. If you don't enroll during your Initial Enrollment Period (IEP)* or you don’t have creditable coverage (coverage greater than or comparable to Medicare), you could face a lifetime penalty on your Medicare premium(s).

*The IEP is a seven-month window that surrounds someone’s 65th birthday. It begins three months before their birth month, includes the birth month, and ends three months later. For example, if someone was born on July 10, their IEP would begin on April 1 and end on October 31.

Most individuals qualify for Medicare Part A and Part B when they turn 65, so long as they or their spouse worked at least 10 years (40 quarters) and paid into Social Security taxes. Together, Part A and Part B are considered “Original Medicare.” However, most enroll in a Medicare Advantage or Medicare Supplement (Medigap) plan to provide extra benefits and fill in the gaps that are not covered by Original Medicare. Learn more here.

2. Working Past Age 65 With Creditable Coverage

You can enroll in Medicare and continue working full time or part time. Retirement is not a requirement for Medicare! However, you can sometimes delay Medicare Part A and Part B if you have creditable coverage through your or your spouse’s employer. “Creditable coverage” is coverage greater than or comparable to Medicare. It’s important to keep in mind that even if you have creditable coverage through your employer, you may still need to enroll in Medicare Parts A and B depending on the number of employees within your company. You will not be penalized if you qualify for a Special Enrollment Period (SEP).* Depending on your Special Enrollment Period type, you may have up to 2 months before or 2 months following the event to enroll in a Medicare plan.

*You qualify for a SEP when you’ve had certain life events, including losing or dropping employer health coverage or if your household income is below a certain amount. If you are over 65 and still employed with health coverage through your job or your spouse's job, you may qualify for a SEP when you come off of employer coverage or if you lose coverage.

However, it’s crucial to compare your employer plan to Medicare as you may enhance your coverage and get additional benefits. Learn more here about working past 65.

You will want to apply for Medicare Parts A and B even if you stay on your employer plan if either of these apply:

- You are age 65 or older and your employer has fewer than 20 full-time employees

- You are under age 65 and eligible for Medicare and your employer has fewer than 100 full-time employees

Your Medicare will pay first as the primary payer, and your employer plan will pay secondary. If you do not sign up for Medicare A and B, you may be responsible for whatever Medicare would have paid, which can really add up!

3. Past Age 65 Without Creditable Coverage

If you are 65 or older and don’t have creditable coverage (coverage greater than or comparable to Medicare), you could face a lifetime late-enrollment penalty on your Medicare premium(s). You may qualify for the General Enrollment Period (GEP).*

*The General Enrollment Period runs from January 1 through March 31 each year. A person who is eligible for Medicare can enroll in Medicare Part B during the GEP if they did not enroll during their Initial Enrollment Period or during a Special Enrollment Period. Those who have to pay a premium for Medicare Part A may sign up for Part A during the GEP, if they didn’t enroll during their Initial Enrollment Period. Most people do not have to pay a premium for Part A, so they can enroll in it at any time once they’re Medicare-eligible.

How do I apply for Medicare?

You'll sign up for Medicare Part A and Part B through the Social Security Administration. You can go to your local Social Security office and sign up, but it is convenient to apply online here.

Once you’re enrolled in Medicare, you will receive a red, white, and blue Medicare card in the mail. After you enroll in Medicare Part A and B, you will have what’s considered Original Medicare only, which leaves gaps in coverage. Many individuals decide to enroll in a Medicare Part C (Medicare Advantage) or Medicare Supplement (Medigap) plan to provide extra benefits and fill in the gaps that are not covered by Original Medicare.

In order to obtain Medicare Part D (prescription drug) coverage, you can either purchase a stand-alone Medicare drug plan (you must first be enrolled in Medicare Part A and/or Part B) or enroll in a Medicare Advantage Prescription Drug (MAPD) plan, which includes Part A, Part B, and Part D benefits.

We generally would advise you to sign up for Medicare Part A at 65, even if you are covered by employer-sponsored health insurance. Most individuals are able to get Medicare Part A without a premium because they have contributed to Medicare taxes throughout their working years. However, it's worth noting that in certain circumstances, you may want to delay enrolling in Medicare Part A, such as if you want to keep contributing to a Health Savings Account (HSA). You are required to stop making contributions to an HSA when you enroll in any part of Medicare.

If you are happy with your current coverage, we may advise you to enroll in Medicare Part A and delay Medicare Part B until you are ready to come off employer coverage. Medicare Part A is typically premium-free for most people; however, Part B does have a monthly premium. We can compare your current coverage to Medicare to see which is the better fit.

It depends on your situation. If a person is drawing Social Security when they turn 65, they will automatically be enrolled in Medicare Part A (hospital insurance) and Part B (medical insurance). Additionally, if an individual collects Social Security Disability Insurance (SSDI) for more than 24 months, they become eligible for and will automatically be enrolled in Medicare. In both cases, Medicare Part A is mandatory, and Medicare Part B is voluntary. Whether you keep your Part B or defer it will depend on your individual situation.

No. Medicare plans do not allow dependents like employer plans do. This means that if your spouse is currently covered by your employer benefits, he or she will have to make arrangements to secure health coverage when you transition to Medicare. Learn more here.

Unfortunately, no. You will still pay medical costs when you’re enrolled in Medicare, just as you would with most other health coverage. Most beneficiaries will be required to pay monthly premiums and other out-of-pocket costs.

Your costs will vary based on the kind of coverage you choose:

- Original Medicare (Medicare Part A and Part B)

- Medigap/Supplement plan

- Medicare Advantage plan (Medicare Part C)

- Medicare prescription drug plan (Medicare Part D)

If you would like help comparing your Medicare options, we’re here to guide you.

Once you apply for Medicare, you may no longer contribute to or receive new Health Savings Account (HSA) deposits from your employer. However, you may still use your existing HSA funds to pay for qualified medical expenses, including some Medicare costs. You can find details about when you should stop contributions to your HSA in this article.

How do I choose the right plan?

Comparing Medicare plans on your own can be a daunting task. Let our team of experts in Medicare research your options and guide you through a simple three-step process to identify the right plan that meets your needs and budget. Learn more here.

Can RetireMed help me apply for Medicare?

Yes! We’ve helped over 50,000 individuals just like you enroll in the right Medicare plan across Ohio, Kentucky, Indiana, Pennsylvania, and Florida. RetireMed provides you clarity and helps you find the right plan for your unique needs, budget, and lifestyle. We work with most major insurance companies to make sure you have access to a wide range of reliable coverage options. Plus, you’ll enjoy lifelong support – all at no cost or obligation.