What are Medicare Supplement (Medigap) Plans?

Medicare Supplement insurance is extra insurance you can buy to help pay your share of out-of-pocket costs in Original Medicare (Parts A and B).

What You Need to Know About Supplement Plans

Medicare Supplement plans, also known as Medigap, are health insurance policies sold by private insurance companies. Generally, you must have Original Medicare – Part A (hospital insurance) and Part B (medical insurance) – before you can buy a Supplement/Medigap policy.

These plans are designed to be paired with Medicare Parts A and B to “fill in the gaps” that Medicare does not cover (like copays, coinsurance, and deductibles). Medicare pays its share of approved covered health care costs and sends the remaining balance to the individual’s insurance company. The Supplement will pick up some or all of the remaining costs.

Supplement plans do not have required provider networks, so you can see any doctor or specialist who accepts Medicare. You typically pay little in out-of-pocket expenses for covered medical services, however, you will pay an additional monthly premium. The plan will only pay your coinsurance after you’ve paid the deductible (unless the policy also covers your deductible).

Given that Original Medicare does not have an annual out-of-pocket maximum, many individuals find Medicare Supplement plans appealing because they can help protect you from high medical expenses. This health plan only covers one person, so if you and your spouse both want Supplement coverage, you each will need to buy your own policy. Since Original Medicare doesn’t cover prescription drugs, individuals with Supplement plans usually purchase a stand-alone Prescription Drug plan (PDP) to help cover the costs of their prescriptions.

How Supplement (Medigap) Plans Work

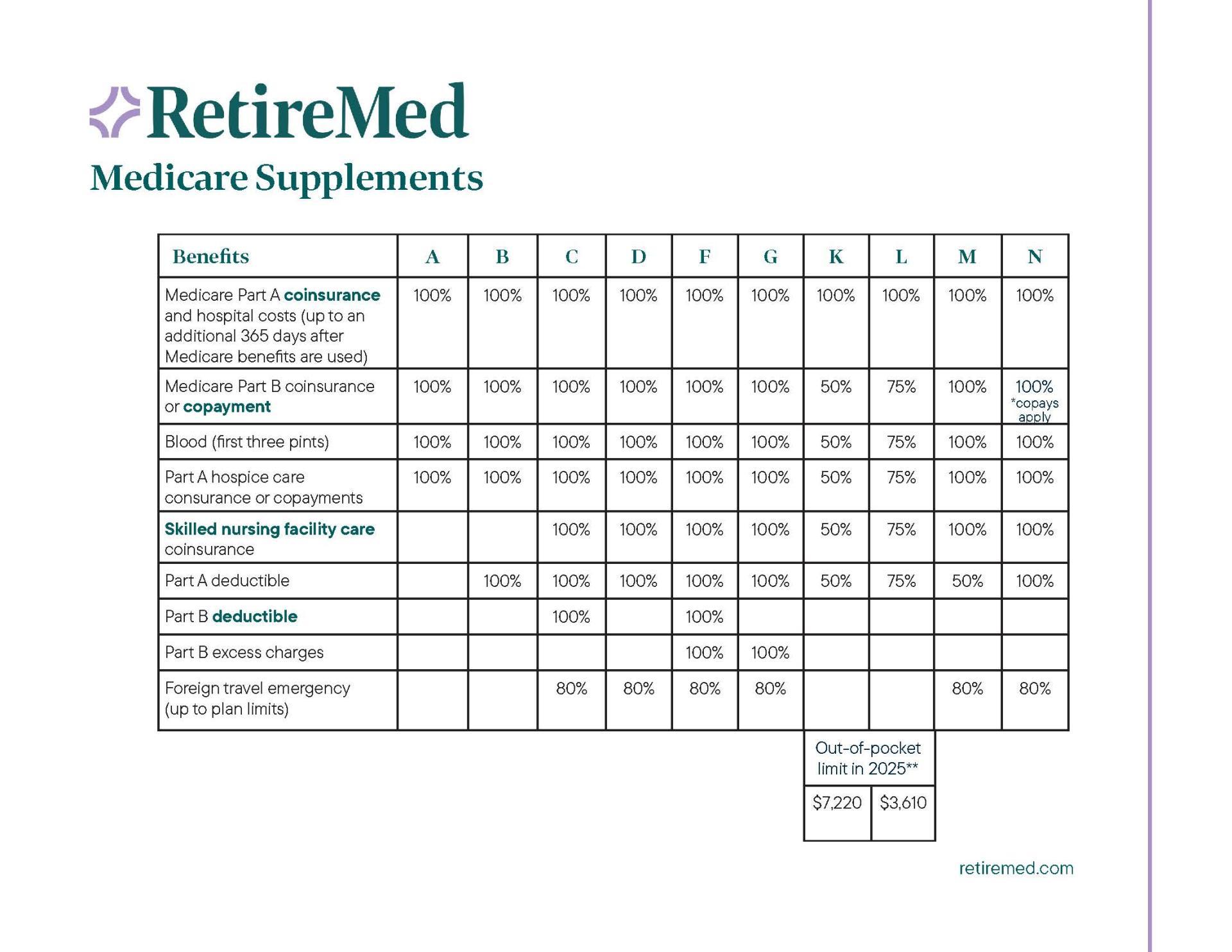

There are 10 different types of Supplement plans so you can buy the one that best meets your needs and budget. All of these policies are standardized and designated by letters: A-D, F, G, and K-N. Plans with the same letter offer the same basic benefits no matter where you live or from which insurance company you buy the plan. Each Supplement policy must follow federal and state laws designed to protect you. Not all plans are offered in every state. Price is the only difference between plans with the same letter.

The chart below shows the different benefits that Supplement/Medigap plans cover.

1Plans F and G also have high-deductible options which require first paying a 2025 plan deductible of $2,800 before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. However, high-deductible plans F and G count your payment of the Medicare Part B deductible toward meeting the plan deductible.

*Medicare first eligible before 2020 only

What is Covered?

Supplement plans help cover out-of-pocket costs associated with Original Medicare, such as:

- Copayments (fixed dollar amount set by the insurance company that you are responsible for paying)

- Coinsurance (a percentage of the cost that you are responsible for paying)

- Deductibles (the amount of money you pay before your insurance kicks in)

What is Not Covered?

Supplement plans generally don’t cover:

- Part D prescription drugs

- Dental care

- Vision care or eyeglasses

- Hearing aids

- Long-term care (such as a nursing home)

- Private-duty nursing

Prescription Drug Coverage

Medicare Supplement plans do not offer Part D benefits, so those on a Supplement plan need to enroll in a stand-alone Medicare Part D prescription drug plan or another form of creditable drug coverage (meaning coverage equal to or greater than Medicare’s minimum standards of coverage). If you chose not to pair drug coverage with your Supplement plan, you could be charged a Late Enrollment Penalty (LEP) the next time you try to sign up for a drug plan.

Dental, Vision, and Hearing Coverage

Those on Supplements have the option to purchase additional stand-alone coverage benefits if they choose.

How much do Supplement/Medigap plans cost?

While the majority of Supplement enrollees receive minimal bills for health care expenses, they do pay a monthly premium, in addition to their Part B premium. You will likely pay a higher monthly premium for a Medicare Supplement than you will for a Medicare Advantage plan. These Supplement premiums can increase each year.

Each insurance company sets the price, or premium, for its Supplement plans. Each Supplement policy can be priced or “rated” in one of three ways:

- Community-rated: Generally the same premium is charged to everyone regardless of age or gender. Premiums may go up because of inflation and other factors but not because of your age.

- Issue-age-rated: The premium is based on the age you are when you buy the policy. Premiums may go up because of inflation and other factors but not because of your age.

- Attained-age-rated: The premium is based on your current age and goes up as you get older.

Once you buy a Supplement plan, you can keep it as long as you pay your premiums. All standardized policies are automatically renewed every year, even if you have health problems. Your Supplement insurance company can only drop you if:

- You stop paying your premiums

- You weren’t truthful on the application

- The insurance company goes bankrupt or goes out of business

Supplement/Medigap Enrollment Period

Your Medigap Open Enrollment Period is a one-time enrollment period and doesn’t repeat every year, like the Medicare Annual Enrollment Period. The six-month “Medigap Open Enrollment” period begins the first month you have Medicare Part B and are 65 or older. During this period, you can enroll in any Supplement/Medigap Plan and the insurance company can’t deny you coverage due to pre-existing health problems. After this period, you may not be able to buy a Supplement plan, or it may cost you more.

Working Past Age 65 and Medicare Enrollment

Retirement is not a requirement for enjoying the benefits of Medicare. Many individuals aged 65 and older are delaying retirement and staying in the workforce. If you’re working past age 65, you can sign up for Medicare regardless of your current employment status.

We make it easy to enroll in Medicare without retiring. Our advisors provide personalized guidance to help you choose the health plan that is right for you.

Questions? Our experts have answers.

Whether you plan to apply for Medicare now or in the near future, our team of advisors will guide you every step of the way. From researching and comparing plans to help choosing a plan and enrolling, we do the heavy lifting, so you don’t have to spend countless hours figuring it out on your own. Our support doesn’t stop there - we provide lifelong assistance to all our clients.

If you have questions or want to begin your transition to Medicare, call our team to get started. We’ve helped over 50,000 individuals in Ohio, Kentucky, Indiana, and Florida find the right plan.

Your 2025 Complete Guide to Medicare

We know how to make Medicare work for you.

Medicare can be complicated but we’re here to help. Let’s get started with the basics.