2025 Changes to Medicare Part D: What You Need to Know

The Inflation Reduction Act (IRA) encompasses a variety of initiatives. For Medicare beneficiaries, this legislation is noteworthy because it implements substantial cost-saving measures that will affect Medicare Part D for many years. Medicare Part D (Medicare prescription drug coverage) is available to anyone enrolled in Medicare Part A and/or Part B and is offered by private insurance companies.

In 2022, changes to Part D resulting from the IRA began to take effect, and further changes continue based on timing outlined in the legislation. Here are the Part D changes effective in 2025.

Changes to Medicare Part D for 2025

The following Part D provisions of the Inflation Reduction Act are being implemented this year.

$2,000 Cap on Out-of-Pocket Costs

A $2,000 out-of-pocket maximum is now in place for prescription drugs covered by Part D plans. This means that the most an individual will spend on covered prescriptions in a calendar year is $2,000.

Although the new cap is beneficial for those on Medicare, insurance companies have had to determine how to accurately price their drug plans as a result of this change. Consequently, insurance carriers have begun to increase drug plan premiums, as well as co-pays and coinsurances for prescriptions. We recommend referring to your prescription drug plan’s Annual Notice of Change for details on your particular plan. As always, our team is here to help if you have questions!

Medicare Prescription Payment Plan

As of Jan. 1, 2025, the Medicare Prescription Payment Plan went into effect. This payment program gives individuals on Part D plans (both standalone Medicare prescription drug plans and Medicare Advantage plans with prescription drug coverage) the option to pay out-of-pocket prescription drug costs in monthly installments over the course of the year if they choose. You can apply for the payment plan by contacting your Medicare plan.

Elimination of the Donut Hole

You have likely heard of the “donut hole”, formally referred to as the “coverage gap.” In 2024 and prior, this stage of drug coverage referred to a gap in Medicare Part D prescription coverage―a short-term limit on costs the drug plan would cover. Because of provisions in the Inflation Reduction Act, starting this year, the donut hole no longer exists.

Drug Cost Negotiations to Continue

Medicare has been able to directly negotiate prices for certain drugs with drug manufacturers as a result of the Inflation Reduction Act, which is a historic first. The initial round of negotiations began in 2023 and will continue annually. This year, Medicare will select and negotiate costs for 15 Part D drugs, with prices going into effect in 2027.

A comprehensive timeline highlighting the Part D provisions of the Inflation Reduction Act can be found here.

Costs of Part D Plans

The costs of Part D plans and the amount you pay for medications are set by insurance companies and approved by the government. Your individual costs will vary based on the medications you take and the plan you choose.

Most Part D plans include:

- A monthly premium

- An annual deductible

- A prescription drug formulary

- Co-pays and/or coinsurance per drug

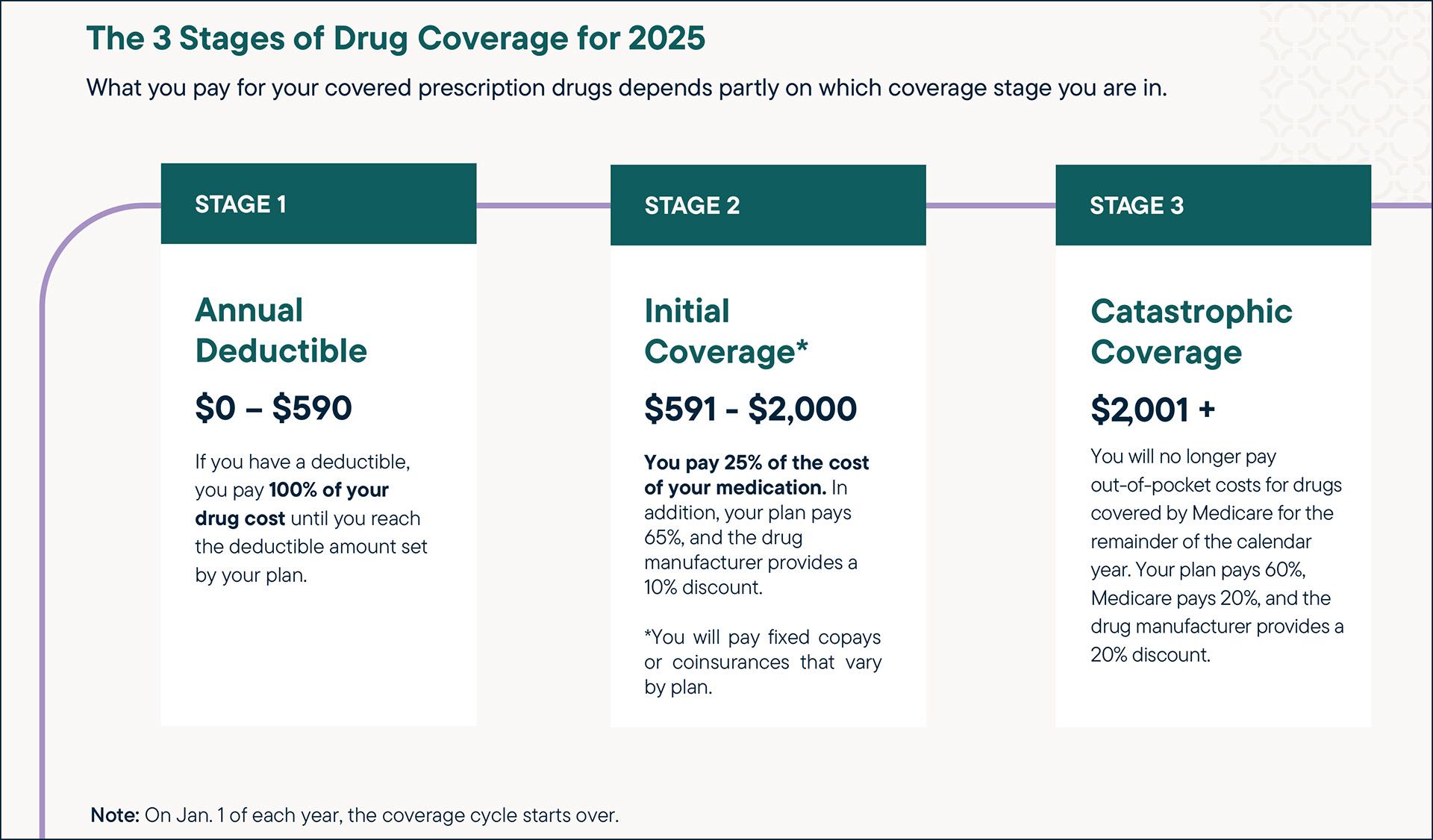

- Stages of coverage

See below for details on the stages of drug coverage.

Questions?

If you are currently a client of RetireMed and have questions about your Medicare prescription drug plan or the changes to Part D, please schedule a call with a client advisor.

If you are new to Medicare and have questions, our advisors are here to help you navigate your health coverage. Call 866.939.8436 today or schedule a call to get started!