How to Help Your Clients Prepare for Health Care Costs in Retirement

As a financial advisor, you know that health care can be one of the largest and most unpredictable expenses for retirees. With rising costs and complex Medicare options, helping clients prepare for health care costs in retirement can feel overwhelming. But you don’t need to be an expert in Medicare, that’s our job.

We’ll help simplify Medicare costs and enrollment for both you and your clients, so they can make confident health care decisions that potentially save money, while you stay focused on their financial future. Plus, our services are provided at no cost to them or you.

Fact: According to Fidelity, the average couple who retired in 2024 at age 65 may need approximately $330,000 to cover health care expenses in retirement.

Retirees and Medicare Premiums

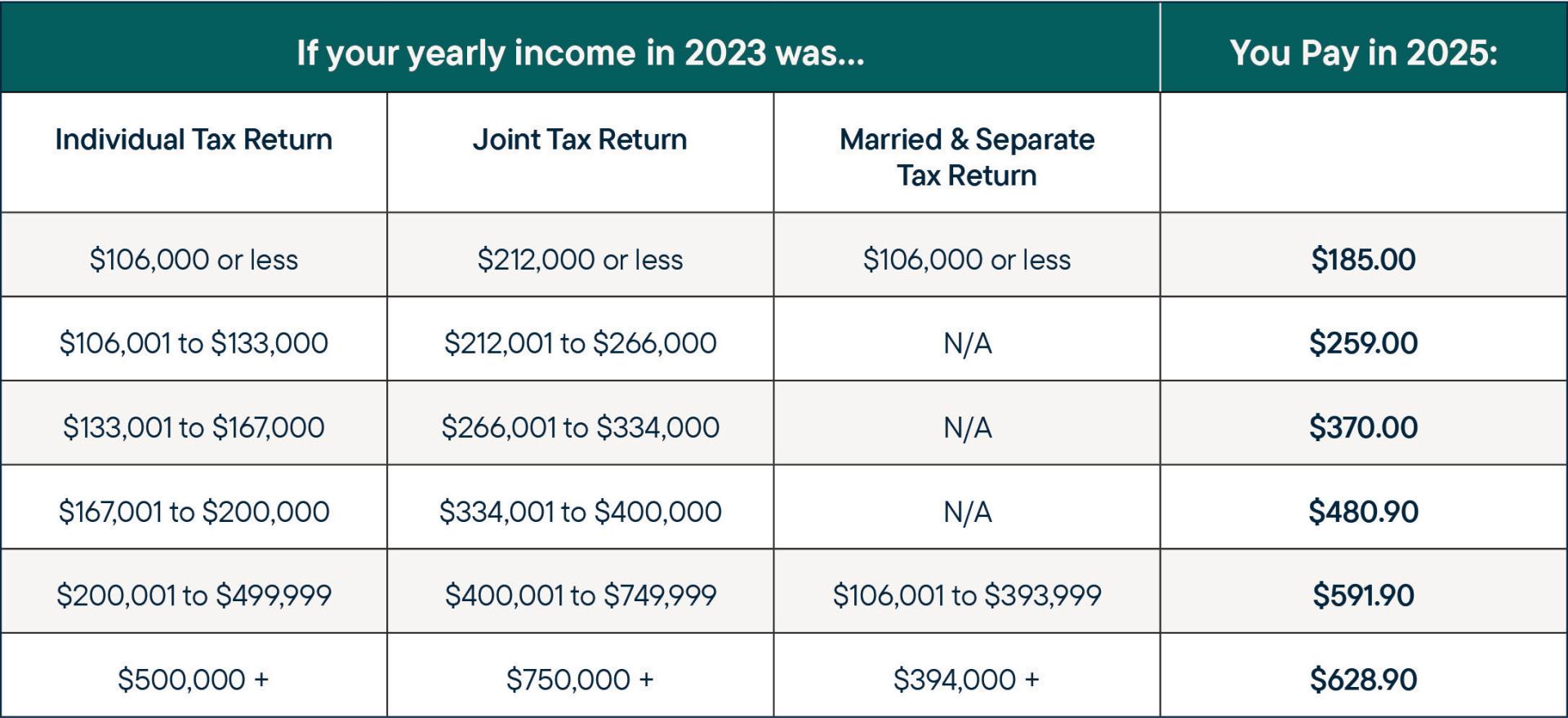

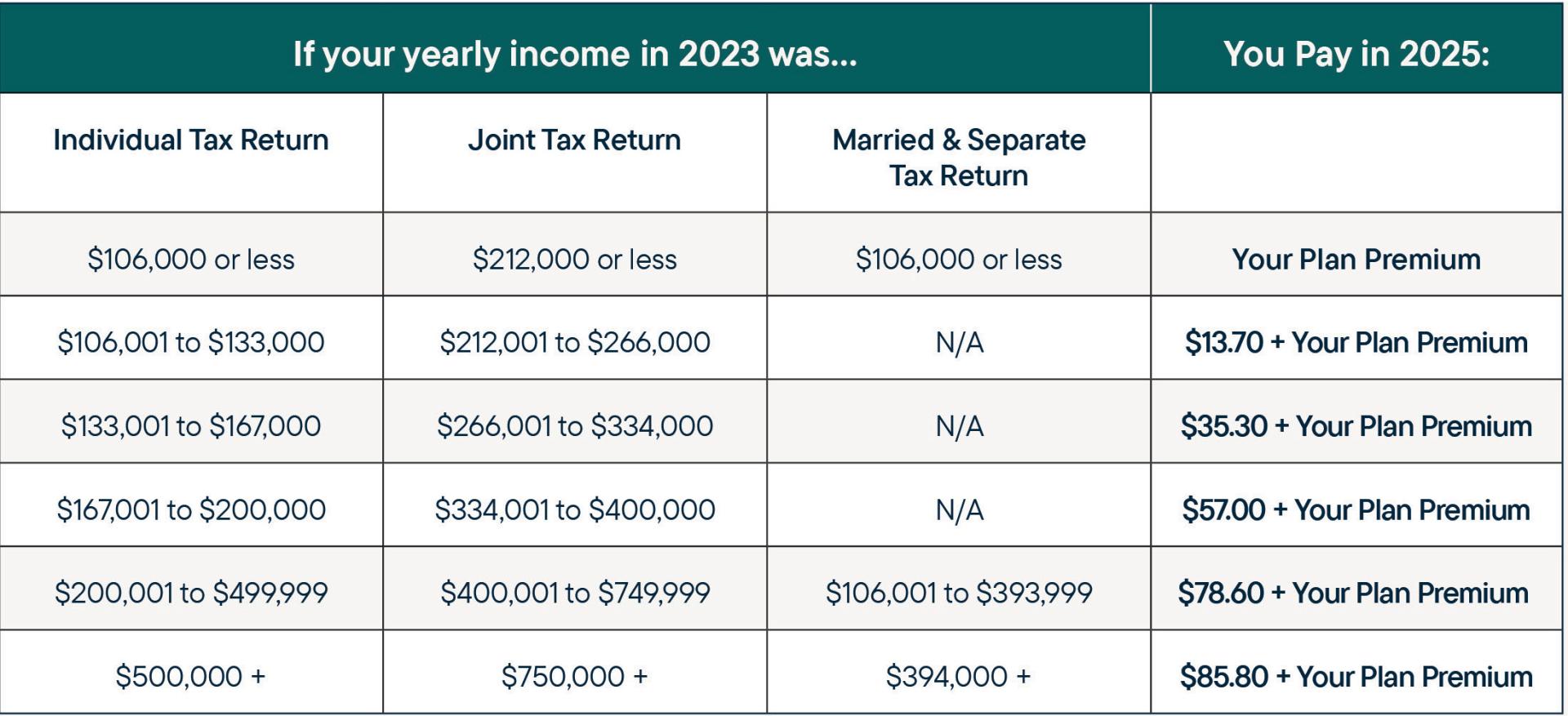

As a financial advisor, it's important to keep it simple when discussing Medicare with your clients. While there are four parts to Medicare, the key components most people will focus on are Part B (medical insurance) and Part D (prescription drug coverage), both of which come with monthly premiums. Clients who have higher incomes may face additional charges for Medicare coverage. This is known as the Income-Related Monthly Adjustment Amount (IRMAA).

Medicare Premiums and Income Adjustments

- Some clients may face higher premiums based on their income.

- In 2025, Part B premiums start at $185, but will increase depending on income.

- Part D premiums can range from $0 to $190 per month, with IRMAA surcharges applying to higher incomes.

Tip for Advisors: Understanding your client’s income level can help you predict their Medicare costs and avoid unexpected surprises.

The wrong plan is costly.

Choosing the wrong Medicare plan can cost your clients more each year and lead to unexpected medical bills that can eat into their retirement savings. Your clients have three options when it comes to enrolling in Medicare:

The Three Medicare Options

- Original Medicare (Parts A and B) covers a significant portion of hospital and medical expenses, but it does not have an out-of-pocket spending cap, meaning enrollees could face unlimited costs for things like deductibles, copayments, and coinsurance.

- We never recommend anyone just stay on Original Medicare. We do recommend adding either Medicare Advantage or Supplement (Medigap) plans, which help limit out-of-pocket expenses. Both are strong options, so the choice is based on their needs, desires, and budget.

- Medicare Advantage (MA) plans can offer out-of-pocket limits that prevent excessive costs. In addition, they usually provide extra benefits.

- Many MA plans come with no additional monthly premium.

- They are generally network based.

- Medicare Supplement plans (also called Medigap) usually have no or low out-of-pocket expenses, which provides financial predictability.

- Supplement plans have an additional monthly premium.

- They usually don’t have networks.

Tip for Advisors: Medicare Advantage plans may be a good option for clients seeking more benefits while keeping their monthly premium costs lower. Medicare Supplement plans may be a good option for clients who want the freedom of no networks and don’t mind paying more in premiums each month. RetireMed’s advisors can help your clients ensure they understand the benefits of these plans.

Employer vs. Medicare

Many people think that Medicare is only for retirees, but this isn’t true! Now more than ever, people are working past 65 to pursue career goals, save for retirement, or reach full Social Security benefits.

If your clients are aged 65 or older, they can sign up for Medicare, regardless of their current employment status. They can enroll in Medicare while continuing their career and adding to retirement savings. Your working status does not impact your eligibility for Medicare. However, enrolling in any part of Medicare can impact your Health Savings Account (HSA).

Additionally, if your clients plan to retire early or have a spouse transitioning to Medicare, we can help them find the right health coverage before they become eligible for Medicare.

Let RetireMed simplify Medicare for your clients.

As a trusted partner for financial advisors, RetireMed provides expert Medicare guidance and individual health insurance solutions for all ages—ensuring your clients’ coverage aligns with their financial goals. We simplify Medicare choices, helping retirees, pre-retirees, and those working past 65 avoid unexpected costs and better manage their health care budgets. Ready to support your clients? Call us or visit retiremed.com/business for more information.

Share This Article