How Your Tax Return Impacts Your Medicare Part B & Part D Premiums

Did you know that the annual cost of your Medicare premium(s) is determined based on your income level? Read more to learn how your income tax return can impact the cost of your Medicare coverage.

How Medicare Uses Your Tax Return

Medicare uses your income tax return to determine how much you pay in health insurance premiums for Medicare Part B and Part D.

Your Medicare premiums for a given year are calculated using your tax return from two years prior. For example, your 2025 Part B and Part D premiums are based on your 2023 tax return.

Medicare Part B Premium

Medicare Part B covers medical visits, including services that are deemed necessary or preventive. Part B is part of Original Medicare (along with Medicare Part A).

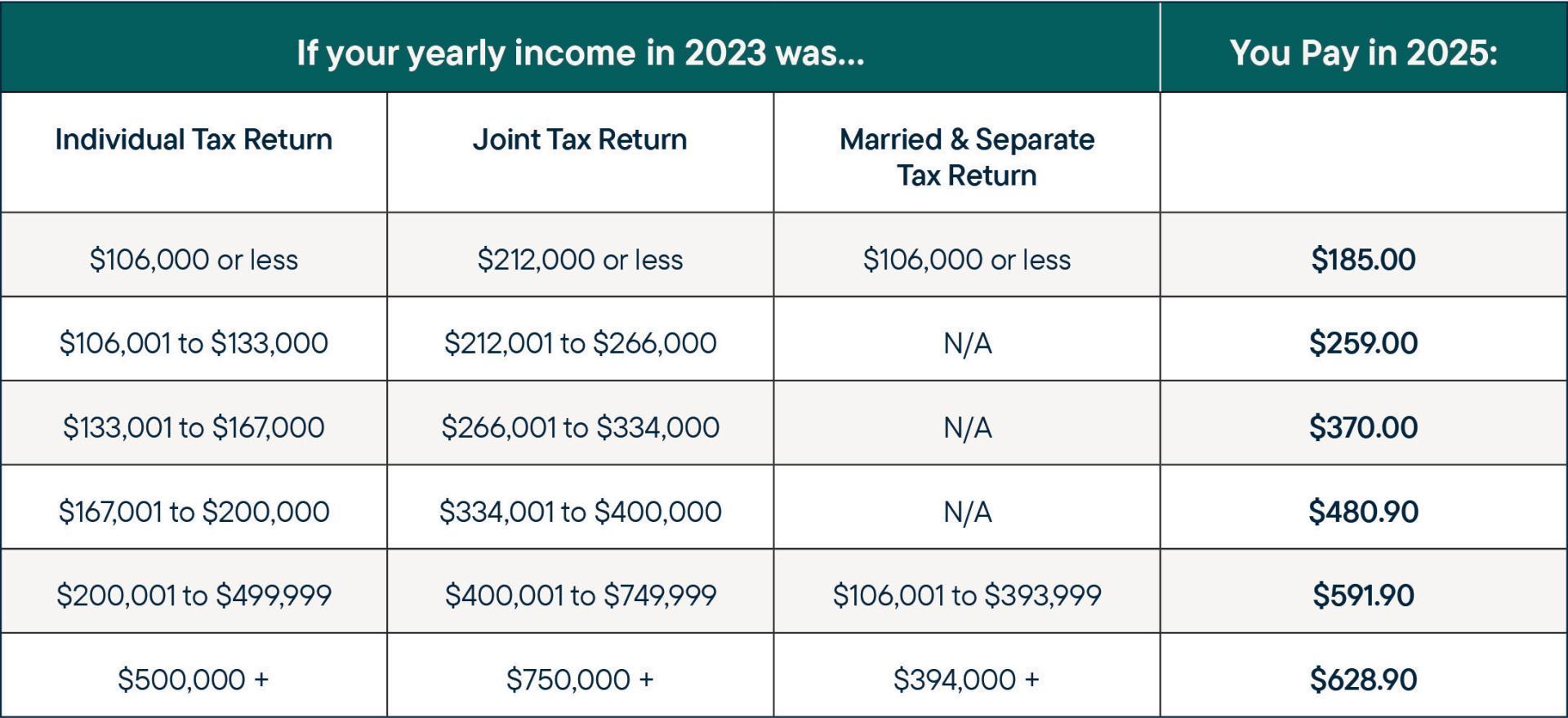

Based on your income level, your monthly premium for Part B could vary. The standard Part B premium for 2025 is $185, but high-income Medicare beneficiaries pay an increased premium. See the table below for more details.

2025 Part B Income-Related Premium Adjustment Amounts

Keep in mind that even if you and your spouse file a joint tax return, you will each pay an individual Part B monthly premium because all Medicare coverage applies individually.

Medicare Part D Premium

Medicare Part D covers prescription drugs and is separate from Original Medicare.

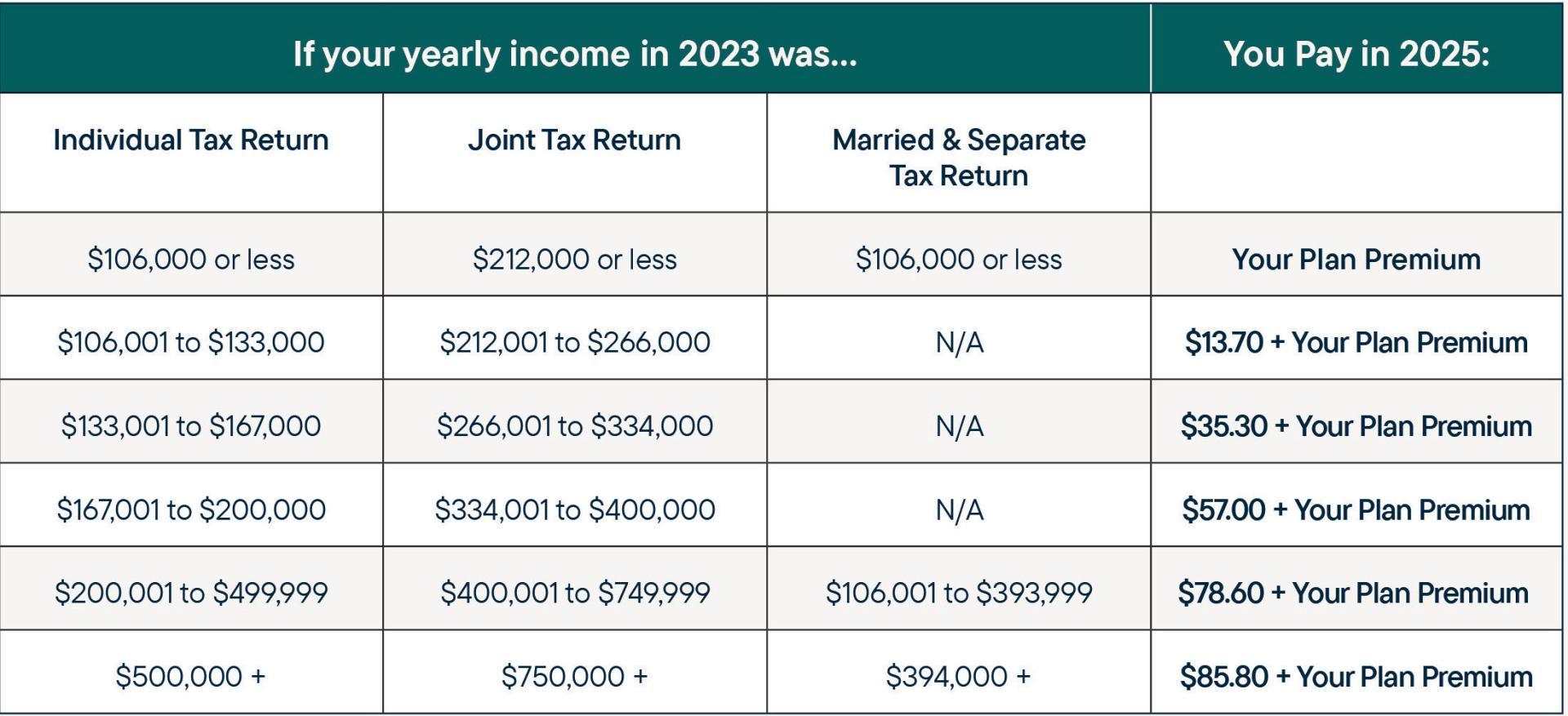

If you have Medicare prescription drug coverage (whether a standalone prescription drug plan or coverage included as part of a Medicare Advantage plan) and are in a high-income tax bracket, you may owe a premium for Medicare Part D in addition to your drug plan premium.

Refer to the table below for more details about monthly premiums for prescription drug coverage.

2025 Part D Income-Related Premium Adjustment Amounts

How do I know if I will pay a higher premium?

If you are required to pay a higher premium due to income, Social Security will send you a letter informing you of the adjusted premium amount(s).

If Your Income Changes

It’s important to know that if you have experienced a life-changing event that has caused a decrease in your income, you may be able to appeal income surcharges and lower your Medicare Part B and D premiums. Even lowering them by one level would significantly decrease your premiums (see charts).

As an example, if you worked full-time in 2023 and retired in 2024, the government will initially base your Part B and D premiums on your 2023 income. By submitting an appeal to Social Security, you would ask them to look at your 2025 projected income instead of your income from 2023 due to work stoppage, which is a qualified life event.

Your income may have changed due to a variety of reasons, including:

- You married, divorced, or became widowed

- You or your spouse stopped working or reduced your work hours

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan

Social Security will ask to see documentation confirming the event and change in your income.

Questions?

If you’re currently a RetireMed client and have questions about your Medicare plan premiums, call 877.222.1942 or schedule a call with a client advisor.

Not a RetireMed client? Whether you have questions about Medicare costs or choosing the right plan, we’re here for you! Contact an advisor at 855.981.8611 or schedule a call.

Share This Blog