Medicare 101: Parts A, B, C, and D Explained

Understanding what you can expect to pay in Medicare premiums can help you prepare for your health care expenses. Different parts of Medicare come with different premiums—some are optional, some are required, some can change based on your income level. We’ve created this guide to give you clarity on Medicare monthly premiums.

But before we dive into premiums, let’s review some terminology. The first thing to know is that Medicare is divided into four parts:

Most individuals qualify for Part A and Part B upon turning 65, so long as they or their spouse worked at least 10 years and paid into Social Security taxes. Parts A and B are considered “Original Medicare.”

Part C (also called Medicare Advantage) combines Parts A, B, and typically D into one plan. Medicare Part D covers prescription drugs. Parts C and D are additional coverage that you can purchase to bolster Original Medicare. While Medicare Parts A and B are mandated by federal and state governments, private insurance companies offer Part C and Part D plans.

Each of Medicare’s parts can come with premiums, or monthly payments, which may be conditional or mandatory. Continue reading to learn more about Medicare premiums and how they apply to you.

Note: All figures listed here are based on 2025 data.

Original Medicare: Part A and Part B

Medicare Part A covers inpatient care: hospitalizations, skilled nursing care, hospice, and home health care. Medicare Part A is premium-free—for most people. If you or your spouse has worked at least 10 years (40 quarters) by the time you turn 65, you receive Medicare Part A at no monthly cost.

Note: While there may not be a monthly premium for Medicare Part A, it is not free. You still pay out-of-pocket costs for medical services.

However, if you or your spouse has worked less than 10 years, you can purchase Part A with a premium of up to $518 each month.

Enrollment penalties can also increase your monthly Part A costs. If you don’t purchase Medicare Part A when you are first eligible, your monthly premium can go up 10 percent. This applies for twice the number of years you could have had Part A but didn’t register. For example, if you didn’t sign up for Medicare Part A for two years after you were eligible, your premium would be 10 percent higher for four years. Then, the premium would go back down to your standard monthly rate.

Read more about late enrollment penalties here.

Medicare Part B generally covers outpatient and preventive care—such as ambulance services, health screenings, and medical equipment. Unlike Part A, every Medicare beneficiary pays a monthly premium for Part B.

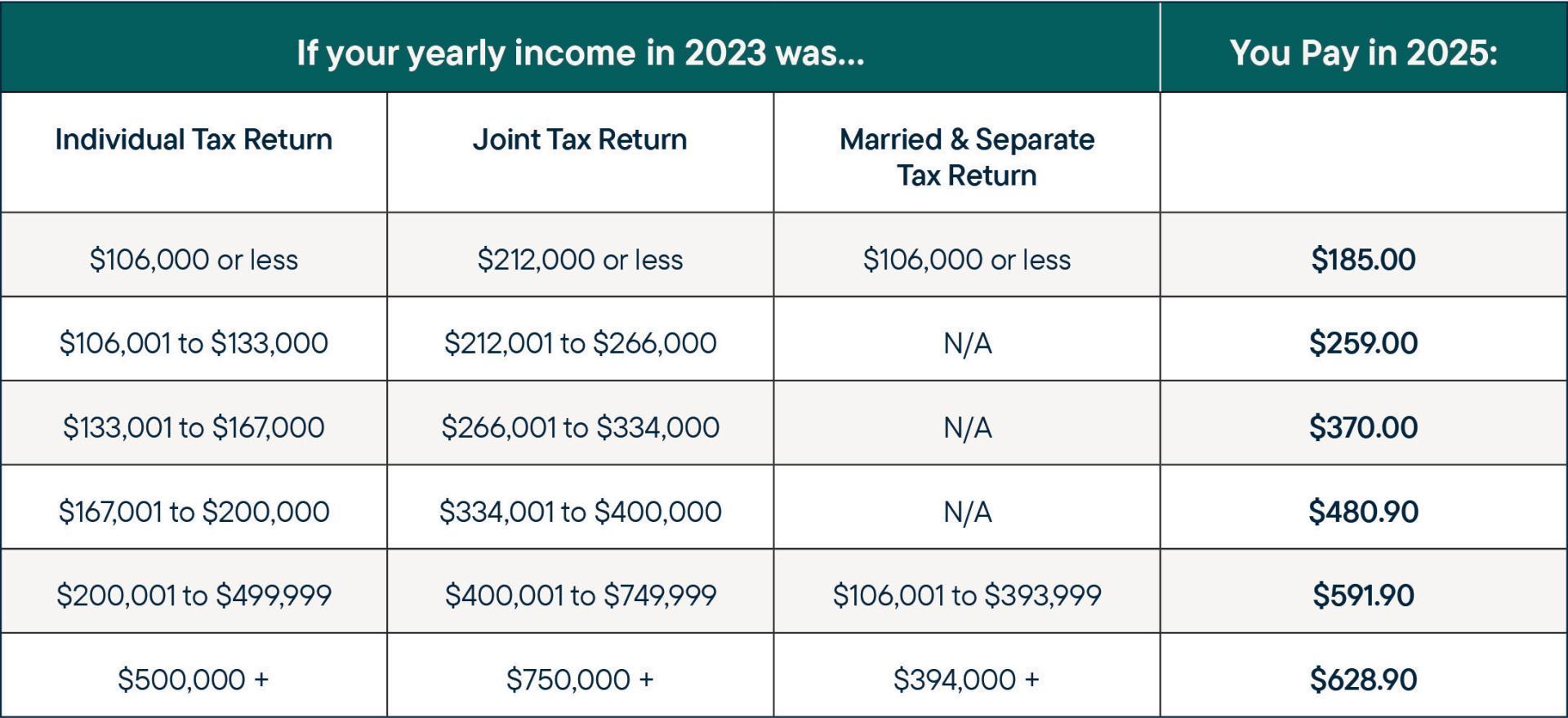

The cost of your premium depends on your annual income—whether you file individually or joint with your spouse. The table below breaks down Medicare Part B premiums for 2025 based on income.

Note: Even if you and your spouse combine your income on your yearly tax return, you each pay an individual Part B monthly premium. All Medicare parts and plans are individual coverage.

Late enrollment penalties can also apply to Medicare Part B. If you wait too long to sign up for Medicare Part B, you can incur a 10 percent premium increase for each 12-month period you were eligible but did not enroll. For example, if you wait until 27 months after your eligibility ends, that totals two 12-month periods without coverage. As a result, your monthly premium would increase by 20 percent (10 percent per period x two 12-month periods) for the remainder of the time you have Part B.

Additional Coverage: Medicare Part C and Part D

Medicare Part C, otherwise known as Medicare Advantage, is available to purchase on top of Original Medicare. Medicare Advantage plans combine Parts A and B, and they often include prescription drug coverage (Part D) and cover additional services not included in Original Medicare. In many instances, Medicare beneficiaries pay no monthly premium for Part C.

However, it all depends on the carrier and the benefits you choose. Your Medicare Advantage plan may come with a low monthly premium. It may cover the cost of your Part B monthly premium as an added benefit. Reach out to one of our advisors for help assessing all your plan options—we’ll keep your current health care expenses in mind as we research available coverage.

You can also purchase prescription drug coverage on top of Original Medicare. Part D plans, like Part C, may or may not come with a monthly premium based on the plan you choose. You can save on the cost of a separate Part D premium by purchasing a Medicare Advantage Prescription Drug (MAPD) plan, combining Parts C and D into a single plan and payment.

FAQS: Medicare Premiums

- Does Medicare Part A have a monthly premium?

- Usually not. It depends on your work history. But if you or your spouse have paid into Social Security taxes for at least 10 years, your Medicare Part A premium is waived.

- Does Medicare Part B have a monthly premium?

- Yes. For most people, it’s $185, but it can be more based on your income. See the chart above.

- What if my income changes? Will it change my Part B monthly premium?

- Your premium likely won’t change unless your income increases or decreases dramatically. It also may not change right away. Your Part B premium is calculated based on your taxable income from two years prior—for example, your 2025 rates are calculated based on your 2023 income.

- Does Medicare Part C (Medicare Advantage) have a monthly premium?

- Possibly, depending on the plan you choose. Many plans are available that have low or no monthly premiums.

- Does Medicare Part D have a monthly premium?

- Possibly, depending on the plan you choose. You may bypass paying a separate Part D premium if your Part C plan includes prescription drug coverage.

- What will my premium cost on a Medicare Supplement plan?

- Supplement (Medigap) premiums vary widely based on the carrier. Some carriers charge different monthly rates for the same coverage, depending on your age, where you live, and when you enroll.

Want to Learn More About Medicare Premiums?

If you’d like trusted advice about Medicare coverage, our advisors are ready to help. Whether you have questions about your monthly premium or choosing the right Medicare Advantage plan, RetireMed can offer guidance on your health care expenses.

Share this article: